Measure News Impact on Stock Price Volatility

The Dataiku News Sentiment Stock Alert System delivers real-time market trend insights, enabling swift strategy adjustments for traders and analysts. AI-driven forecasting allows investment teams to seamlessly integrate findings for continuous strategy improvement.

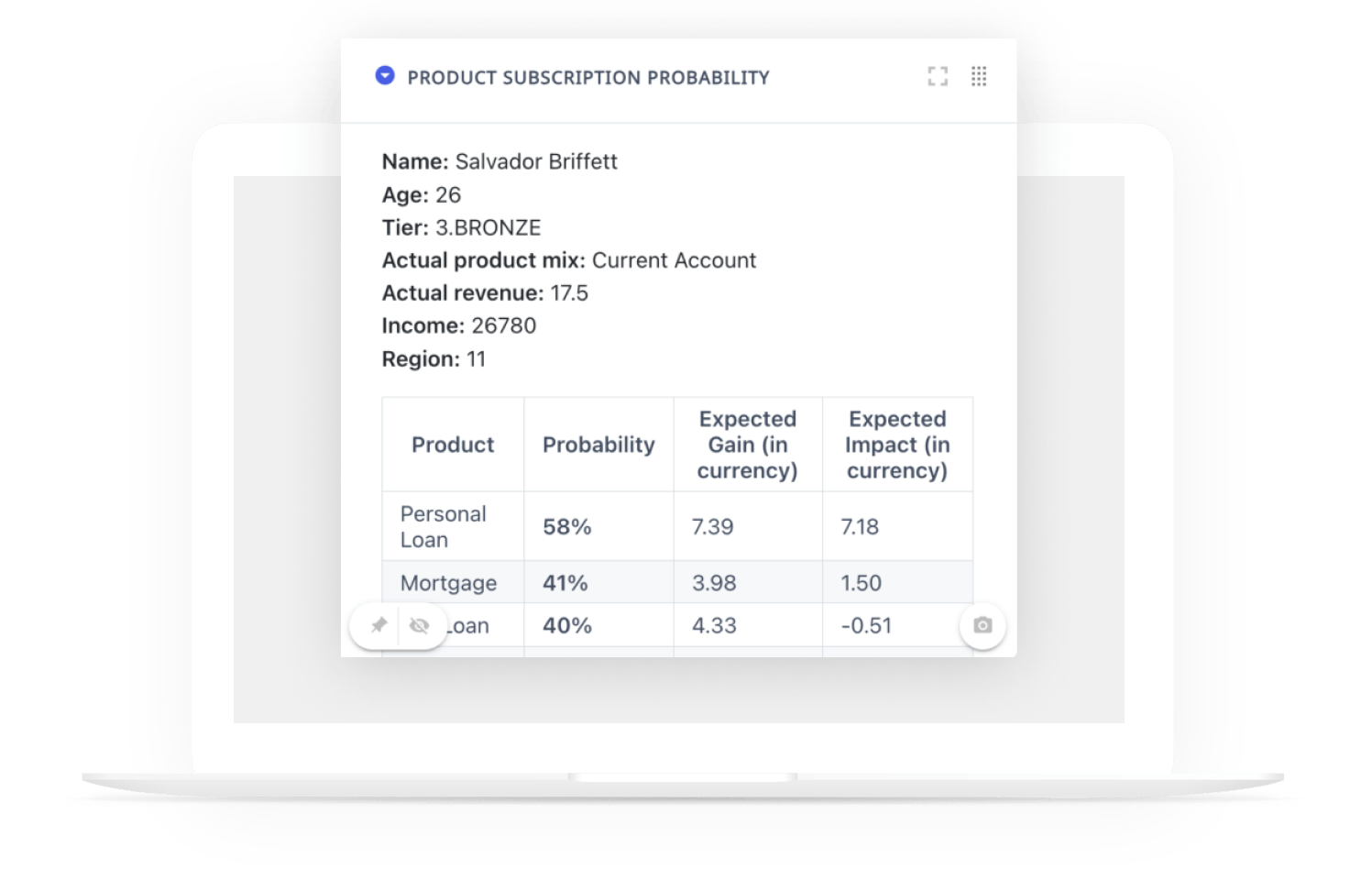

Ready-to-Use Volatility Scores at Ticker Level

A simple web interface adjusts your tracked portfolio and news data sources. See stocks’ volatility score and the likelihood that stock is to exhibit an anomalous move. Then, investigate the news published for a selected ticker to see how each piece was scored, and get a link to the full article so you can dig deeper.

Real-Time Insight Into Ticker-Level Market Movements

Designed to work with a variety of data sources, the system clusters stocks into relevant groups and looks for anomalies in each group, making sure that only atypical movements are highlighted. Stock prices are plotted around anomalous movements, and you’ll also see the news articles published about the stock on neighboring days.

With an accelerated path towards proprietary insights development, you lower your dependency to market data providers and improve your team distinctiveness.

Improve Responses to News Events With Historical Analysis

You’ll have full confidence in each step of using the Dataiku Solution for News Sentiment Stock Alert System with its extensive documentation, fully open code, and built-in explainability tools.

You can analyze stock price evolution on long-term horizons and plot stock prices on any time window you choose, displaying any anomalies in the dataset, enabling you to gain new insights into how the news scoring model performed on an entire dataset.

Tailor the Alert System Solution to Your Needs

Adjust the Dataiku Solution for News Sentiment Stock Alert System to your choice of internal and external data sources, and make it specific to your investment universe and market specificities.

Answer Key Questions

The Dataiku Solution for News Sentiment Stock Alert System helps answer a broad range of questions like:

- What stocks are most likely to move based on current news?

- What are the underlying news events driving volatility for a specific ticker?

- What historical insights can be gained through systematic analysis of past news events?

Go Beyond News-Based Triggers With Dataiku

Why use the Dataiku Solution for News Sentiment Stock Alert System? It allows you — in real-time — to identify news items of most relevance to your portfolio, and explore past trends to understand what news might drive portfolio volatility in the future.

And it’s just a start to comprehensive investment activities augmentation: With the capacity to quickly deliver multiple investment signals, blend them in portfolio optimizers, move from reactive to full anticipation across processes, Dataiku offers investment teams and related functions the capacity to embark on comprehensive AI journeys, with full explainability and extensibility.

The Total Economic Impact™️

Of Dataiku

A composite organization in the commissioned study conducted by Forrester Consulting on behalf of Dataiku saw the following benefits:

reduction in time spent on data analysis, extraction, and preparation.

reduction in time spent on model lifecycle activities (training, deployment, and monitoring).

return on investment

net present value over three years.