Optimize Marketing Spend Efficiency & Customer Interactions

The Dataiku Solution for Next Best Offer (NBO) for Banking quickly identifies customers for effective cross-selling and optimal offers. This solution enables banks to tailor marketing strategies for maximum ROI and enhanced customer retention and growth.

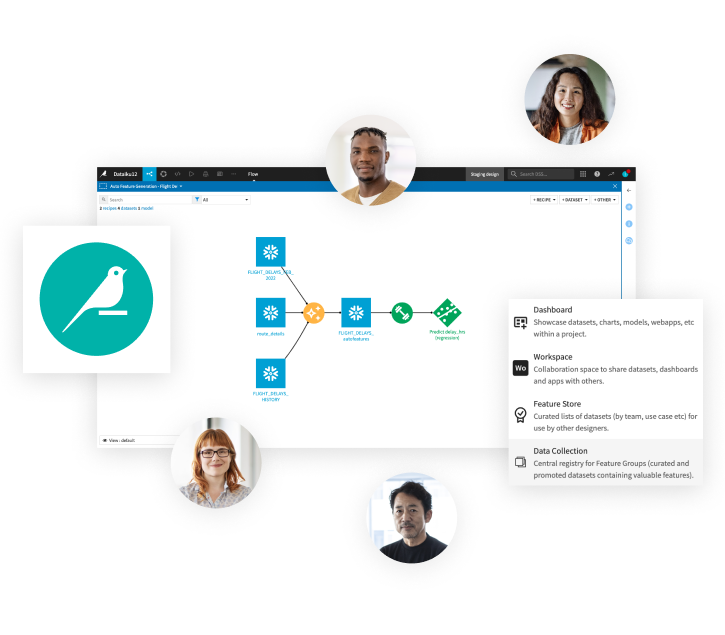

Understand Your Portfolio’s Demographic and Product Mix

Integrate within a streamlined marketing mix allocation workflow coupled with enhanced customer portfolio product mix and revenue data insight. Split by segment and vintage to access quick and comprehensive customer analysis.

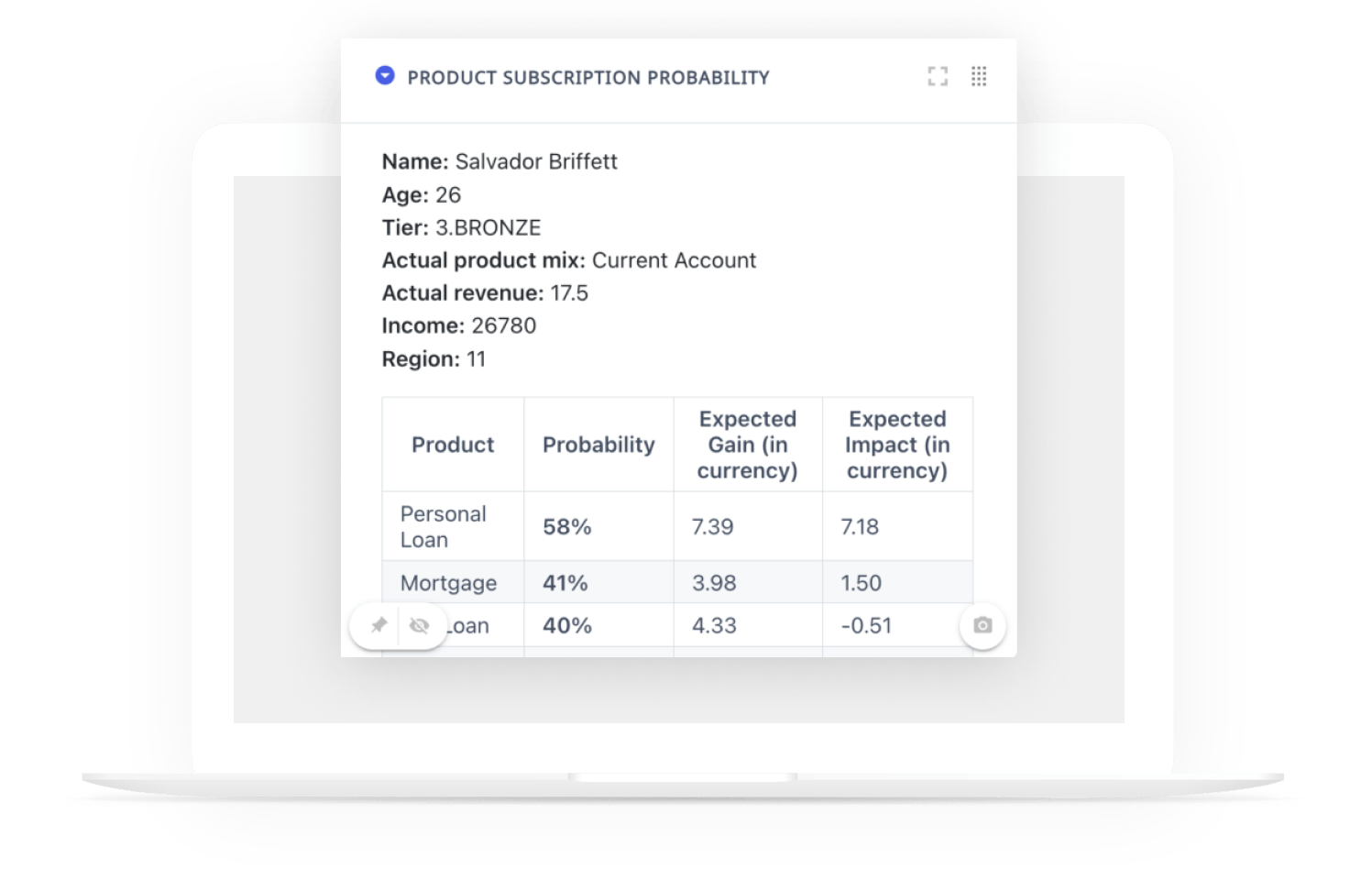

Predict Revenue Gains

Easily understand the revenue potential of each product cross-sell campaign and the customer-level analysis of the product portfolio. More precisely and efficiently allocate marketing spend alongside powerful estimates of customer and campaign revenue.

Better Estimate Marketing ROI

Optimize marketing campaigns with fully explainable ML models. Generate targeted customer lists to engage on specific campaigns, measuring probability to purchase and expected revenue gain, adding precision to marketing ROI.

Integrate Fairness Checks in NBO Models

Govern and analyze the fairness of your model over time with simple diagnostics and a Responsible AI (RAI) framework. Leverage the framework to quickly integrate checks across the entire process.

Adjust to Your Specificities in

a Few Clicks

Generate immediate and actionable results with the step-by-step Project Setup. Quickly load your customer product data and customer data and get started through a few steps.

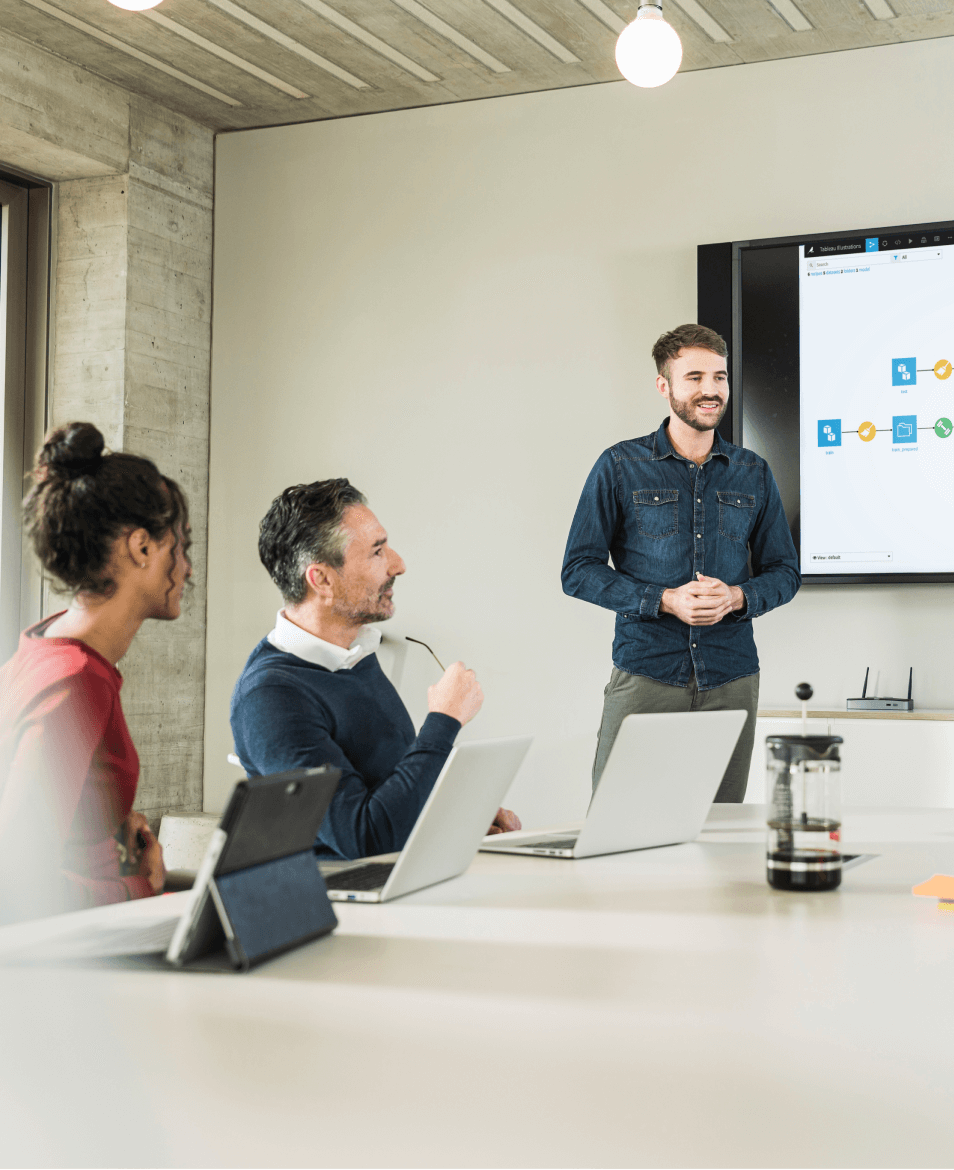

Build and Scale

With Confidence

Accelerate business adoption and scale across activities, brands, and geographies. Have full confidence in each step of the process through the solution’s extensive documentation, fully open code, coupled with built-in diagnostic tools.

Answer Key

Customer Base

Development Questions

The Dataiku Solution for NBO for Banking helps answer a broad range of questions like:

- How can I improve my marketing campaign and make it less expensive and more targeted?

- How can I customize my campaign for a given customer?

- How can our marketing campaign for financial products be quickly scaled on other markets, but still be adopted for particular region specificities?

Jumpstart Toward Enhanced

Customer Management

Quickly develop and scale impactful NBO approaches before multiplying revenue by delivering lead scoring, smart segmentation, customer lifetime value, and more. Dataiku enhances the efficiency of your marketing campaigns and advisory activities through intelligent targeting, product offer personalization, and in-depth customer insights.

The Total Economic Impact™️

Of Dataiku

A composite organization in the commissioned study conducted by Forrester Consulting on behalf of Dataiku saw the following benefits:

reduction in time spent on data analysis, extraction, and preparation.

reduction in time spent on model lifecycle activities (training, deployment, and monitoring).

return on investment

net present value over three years.