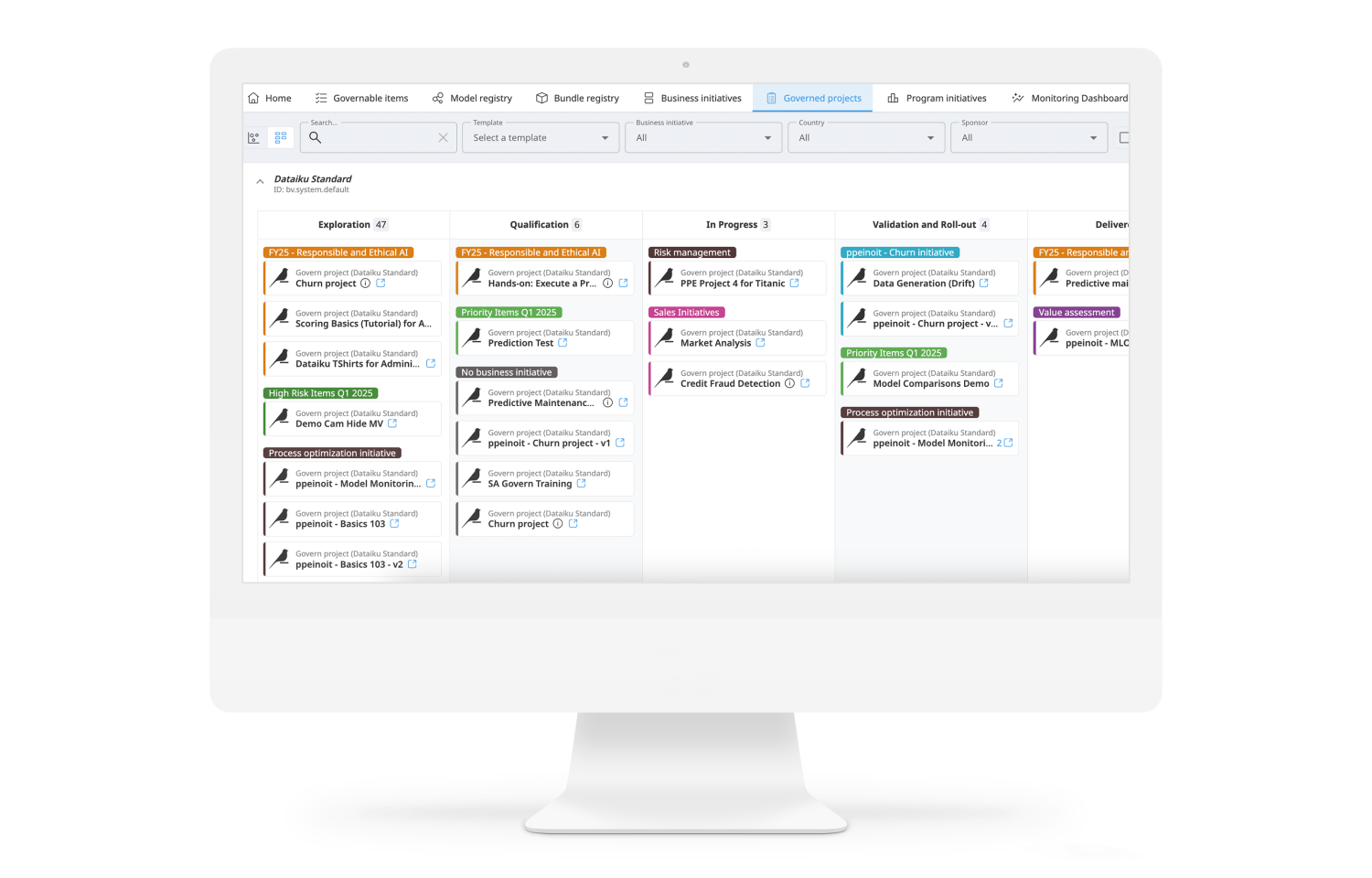

Oversee Projects & Reduce Shadow AI

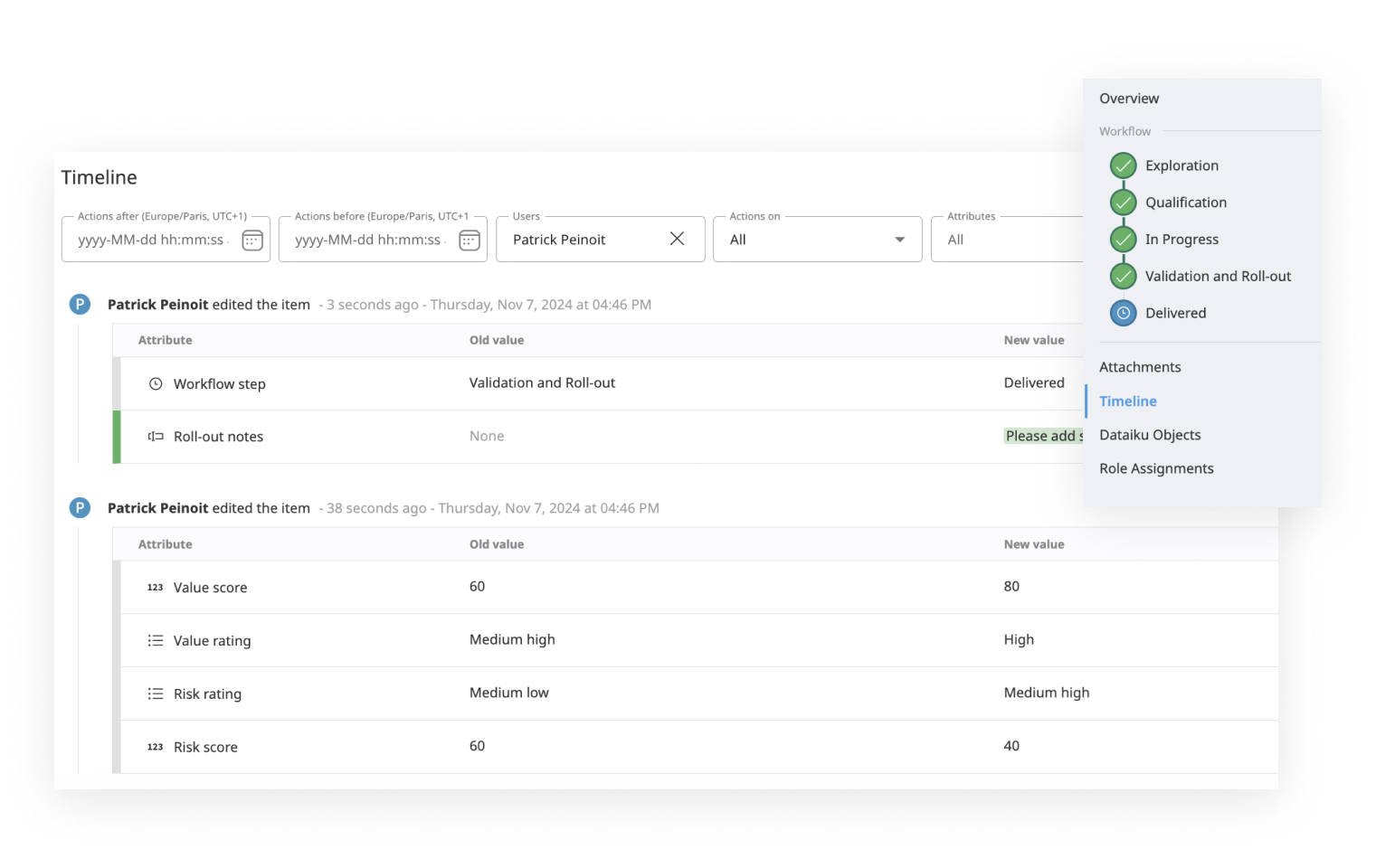

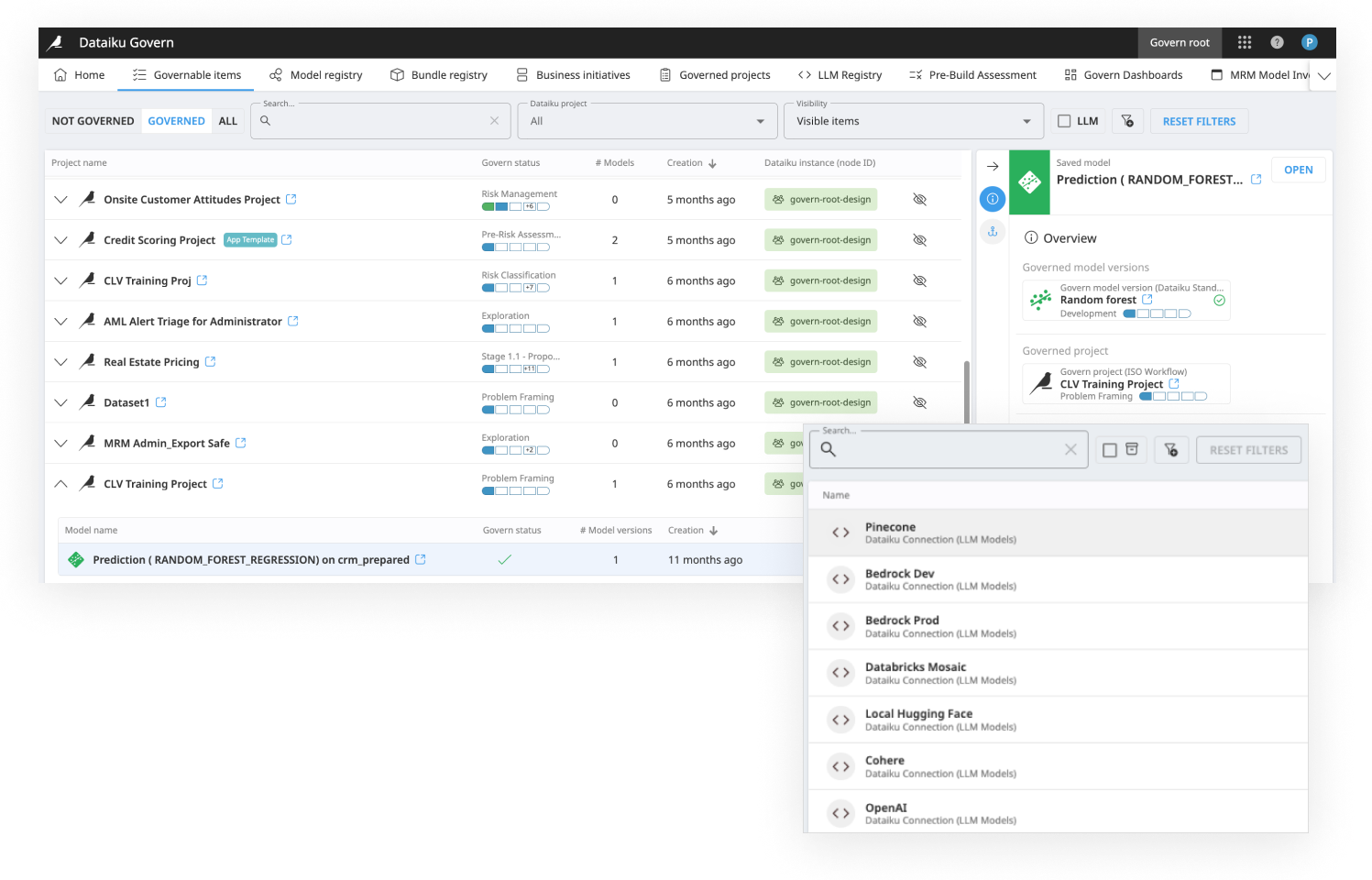

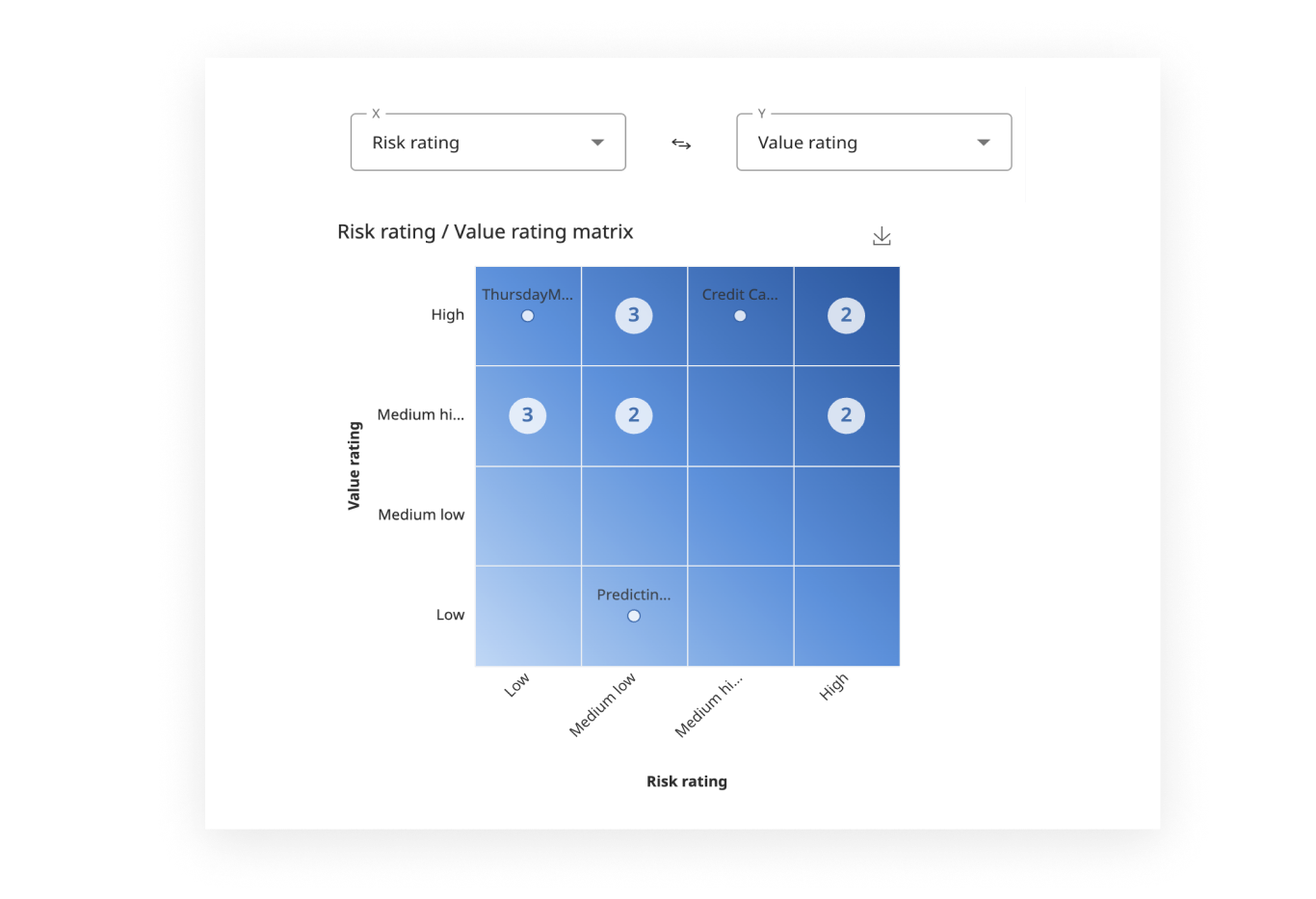

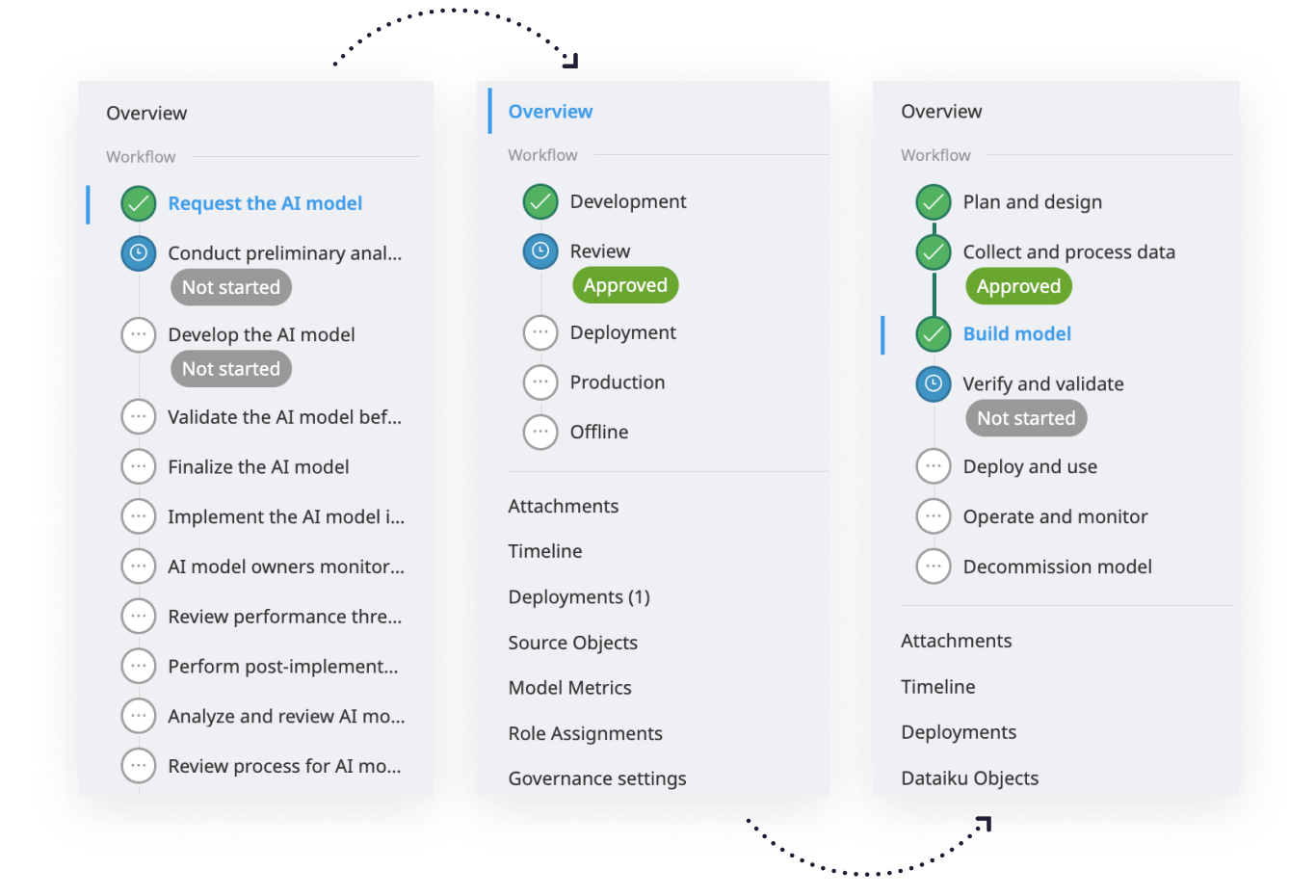

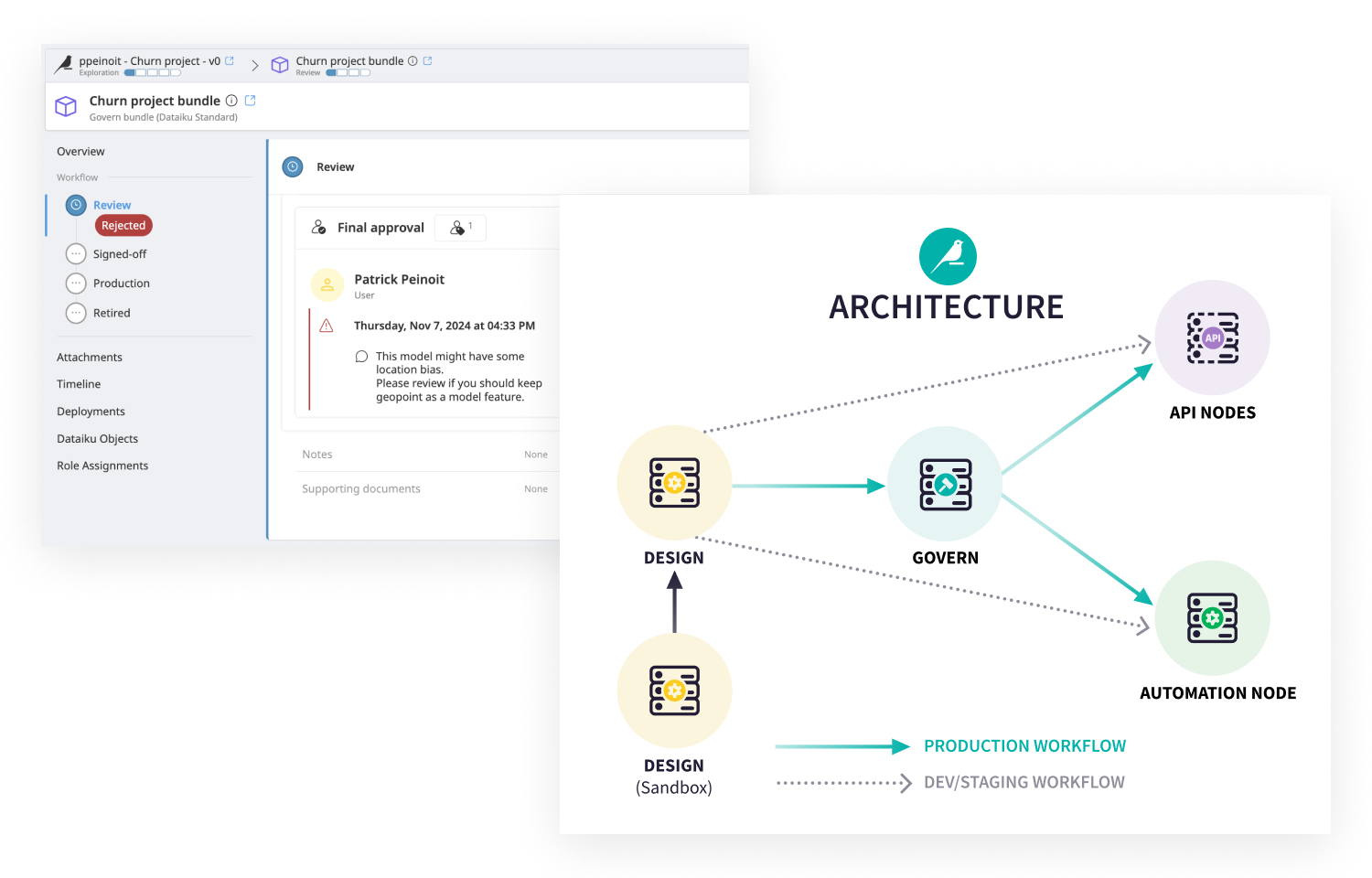

Dataiku Govern centralizes work from across your organization so that you can see all data and AI projects in one single place. This allows for tracking progress and gives the ability to consistently document relevant information about data and AI project progress, scope, stakeholders, and more.

Leverage the Kanban view for a global look at project status, or link and view multiple projects together based on shared business goals.

Learn More About the Risk of Shadow AI