Modernize Your Credit Risk Stress Testing Framework

Transition to a streamlined data pipeline and credit loss modeling approach with the Dataiku Solution for Credit Risk Stress Testing. Go from a patchwork of systems and outmoded architecture to efficient, flexible, and seamless credit risk stress testing with simplified capacity to scale across full credit portfolios.

Accelerate Regulatory Modeling Exercises & Ad-Hoc Analyses

The Dataiku Solution for Credit Risk Stress Testing supports standardized credit risk portfolio modeling exercises, including CECL and IFRS9.

In addition, quickly run ad-hoc credit stress testing analyses to test adjustments at portfolio and top-line levels, measure impact of evolving market conditions on your balance sheet, and more. All this while promoting only the finalized results with documented approval.

Improve Auditability… & Reduce Effort

Built-in governance automatically records all data inputs, outputs, edits, and checks, improving auditability while reducing effort.

The Dataiku Solution for Credit Risk Stress Testing preserves projects — including data, models, and all adjustments — in bundles. That means generating permanent golden copies with the click of a button.

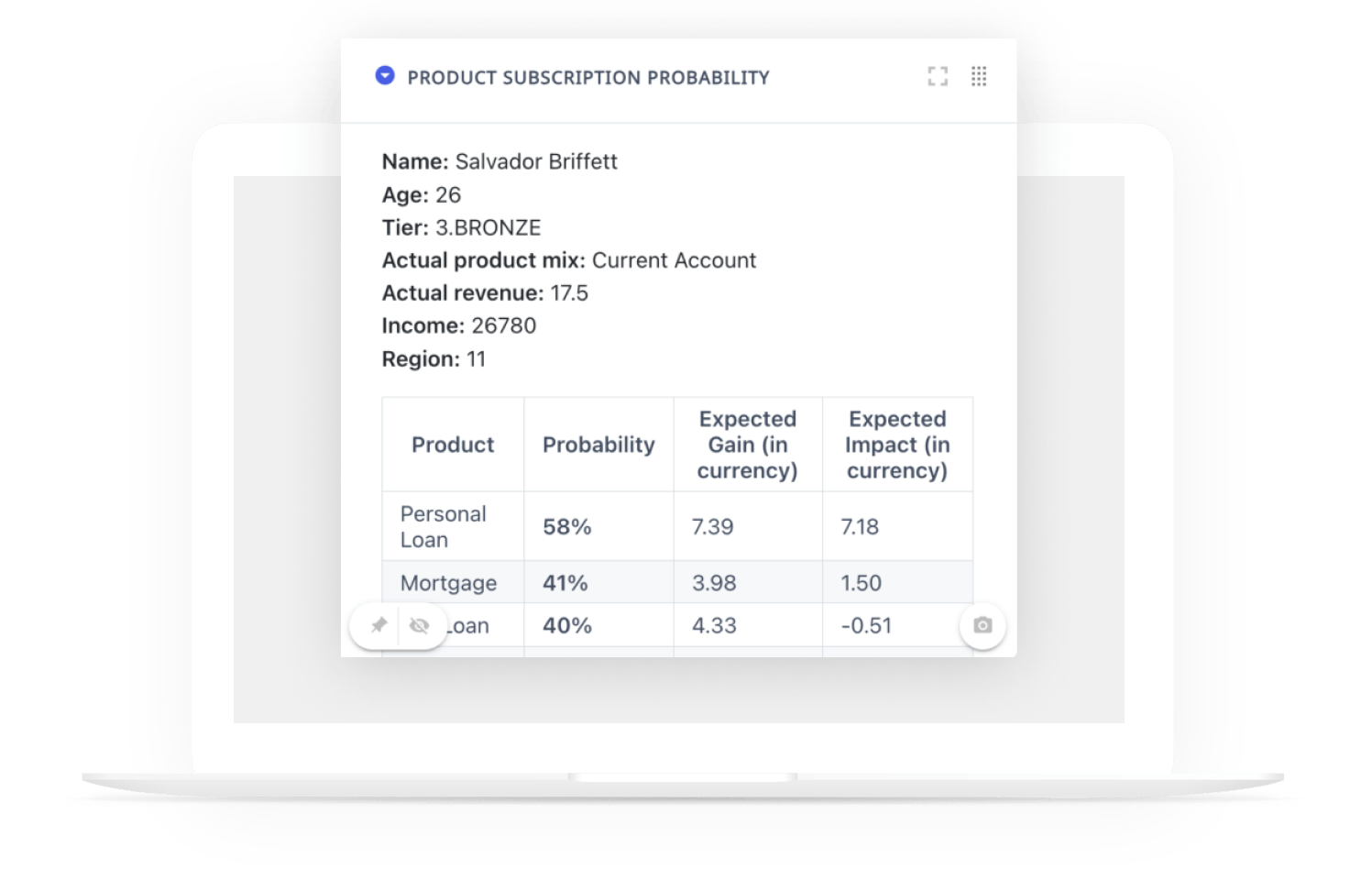

Allow for Granular Adjustments With Total Governance

The Dataiku Solution for Credit Risk Stress Testing provides flexibility and control for managing credit risk in one place. Evaluate and adjust each credit portfolio independently using a shared foundational design with customization as needed. Plus, allow manual, cell-level adjustments by approved individuals and keep full record to orchestrate corrections in input systems.

A permanent audit trail reflects all changes, and users interact only with components relevant to their role.

Guarantee Final Approvals & Auditability

Dataiku facilitates a concrete and rigorous sign-off process for all your credit risk stress testing exercises. Simplify alignment across stakeholders thanks to the built-in governance functionalities — no additional systems needed.

To ease ongoing checks and reviews, the Dataiku Solution for Credit Risk Stress Testing includes a full range of visualizations dedicated to understanding data quality, model settings, aggregate results, waterfalls, and more.

Ensure Robust Data Quality

Data quality checks are executed independently by portfolio and data workflow stage, and outputs tracked. Each portfolio or process owner is fully equipped with means to understand the quality of input data and take action accordingly.

Modernize in Minutes, Not Weeks or Months

While precise credit risk management and provision settings are well established practices, they are also resource intensive. Streamline processes by upgrading to a modern environment with easy-to-manage governance. With freed capacity and improved accuracy, optimize balance sheets and improve reactivity to economic downturns, inflation shocks and other market events.

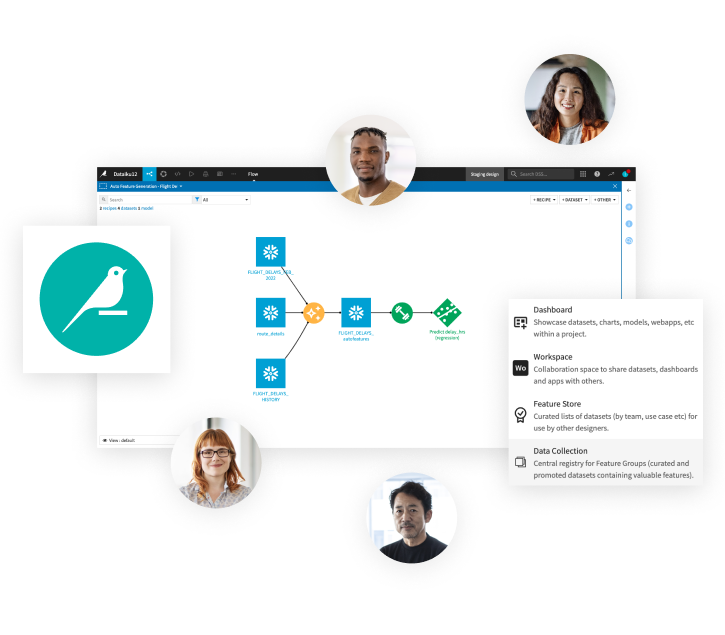

Scale Across Credit Portfolios

The Dataiku Solution for Credit Risk Stress Testing is infinitely customizable to suit your financial institution’s specific needs. Adjust to your specificities and easily scale across your entire credit portfolio. When you’re ready, leverage the established data foundations to engage broader enhancement of your risk management practices.

Go Beyond Credit Risk Stress Testing

Moving to a credit risk governance framework fit for the age of AI is just the beginning. Dataiku empowers risk managers, financial engineers, auditors and all other key banking professionals with a unique transformation opportunity.

Address data quality issues, increase reporting efficiency, accuracy, and ultimately reduce days or weeks of manual work every month. Tackle everything, from the mundane to innovative, moonshot use cases — including cutting-edge Generative AI applications — with Dataiku.

The Total Economic Impact™️

Of Dataiku

A composite organization in the commissioned study conducted by Forrester Consulting on behalf of Dataiku saw the following benefits:

reduction in time spent on data analysis, extraction, and preparation.

reduction in time spent on model lifecycle activities (training, deployment, and monitoring).

return on investment

net present value over three years.